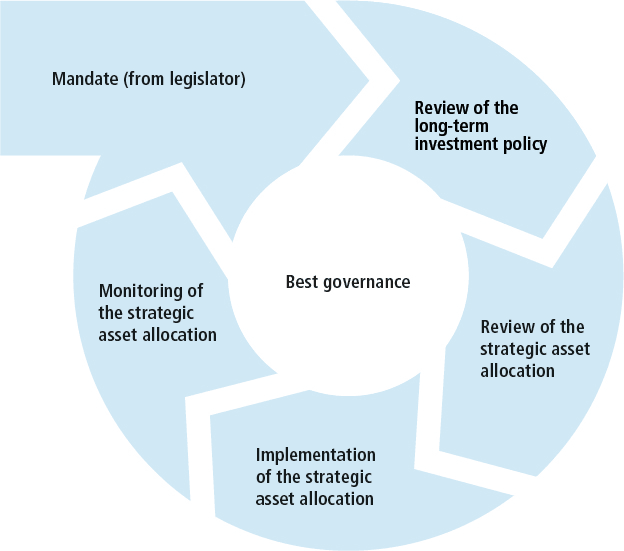

The mechanism that guides our investments

Our investment process

The investment process is the most important mechanism guiding how we invest pension assets. It defines who does what and who is responsible in each case. It ensures that all of PUBLICA’s governing bodies have a shared understanding of our investment activity.

Six steps

PUBLICA’s investment process consists of six steps:

- Our mandate is derived from the PUBLICA Act.

- We review our investment policy at least every four years.

- We also review the strategic asset allocation every four years.

- We implement the strategic asset allocation and

- monitor it continually.

- We apply the principles of best governance, which means we consistently separate the tasks of advising, decision-making and controlling. This allows us to avoid conflicts of interest.

PUBLICA’s mandate sets out its fundamental purpose and is defined as follows: The assets of active members and pension recipients are to be invested responsibly and in their sole interest. While appropriately limiting risks, the aim is to generate a return sufficient to protect active members and pension recipients against the economic consequences of old age, disability and death, and also ensure that the promised benefits can always be paid out in a timely manner.

Art. 71 BVG sets out the principles that must be weighed against each other when making any investment: Pension plans shall manage their assets with a view to safeguarding the security of their investments, and ensuring a reasonable return, appropriate risk distribution and adequate liquidity to cover their foreseeable requirements.

This sub-process identifies and determines the framework for PUBLICA’s activities over the long term, i.e. a horizon of more than ten years, corresponding to PUBLICA’s liabilities.

The steps in this sub-process:

a) defining the investment beliefs:

b) analysing long-term trends

c) determining the permitted asset classes

d) setting the risk budget

a) Defining the investment beliefs

A shared understanding of asset management helps the Board of Directors, Investment Committee and offices of PUBLICA to optimise their response to periods of difficulty without reacting procyclically.

b) Analysing long-term trends

This step involves assessing the impact on PUBLICA of various long-term trends: macroeconomic (e.g. growth rates, interest rates and inflation), demographic, corporate (e.g. developments in head-count among the affiliated employers) and regulatory (e.g. bank disintermediation due to more restrictive capital requirements). A main scenario assumed to be the most likely is defined, along with a range of other possible scenarios, and taken into account in the sub-processes that follow.

c) Determining the permitted asset classes

A structured selection process is used to determine the asset classes that PUBLICA should invest in (or disinvest from) over the long term.

d) Setting the risk budget

The risk budget is set on the basis of the steps set out above and the risk-bearing ability of the pension plans. A relative risk measure is currently used for the open pension plans, whereby the conditional value at risk for the loss of funded ratio (average of the 5% biggest losses of funded ratio at the end of the observation period) is limited. For the closed pension plan, the conditional value at risk for the expected funding shortfall (average of the 5% worst funded ratios at the end of the observation period) is used as the risk measure.

The long-term investment policy review is carried out at least every four years. The timing is coordinated with the term of office of the Board of Directors, to ensure that the review takes place after the new Board members have had time to settle in.

Here the strategic asset allocation is reviewed on the basis of the long-term investment policy.

The steps in this sub-process:

a) risk/return assumptions for each asset class

b) optimisation process

c) consideration of qualitative factors

d) defining the strategic asset allocation

a) Risk/return assumptions for each asset class

This step involves estimating the medium-term (3-year to 5-year) and long-term (10-year) risk/return characteristics for each asset class. Two different horizons are considered because risk premiums are cyclical. Medium-term return expectations take account of economic cycles, while long-term ex-pectations are more strongly geared to equilibrium assumptions. The assumptions regarding correlation between the key asset classes are also discussed.

b) Optimisation process

Here, the restrictions on optimisation are defined and the optimisation process is then carried out. This includes sensitivity analyses, for which a (most likely) main economic scenario is defined, along with key alternative developments. The funded ratio is used as the parameter for the optimisation, in order to take account of the entire balance sheet.

c) Consideration of qualitative factors

This step incorporates into the analysis qualitative factors that are difficult to represent quantitatively (e.g. expansionary monetary policy, liquidity considerations and questions of practical implementation, such as the time required and any restructuring costs).

d) Defining the strategic asset allocation

The strategic asset allocation, including the tactical bandwidths, is then defined on the basis of the three preceding steps. The strategic asset allocation as a whole is reviewed at least every four years.

One central element of this sub-process is the annual strategic monitoring of the key assumptions of the ALM process, in particular the risk/return assumptions for each asset class. If this reveals that the risk/return assumptions have changed substantially since the last ALM study, the entire review of the strategic asset allocation is started afresh.

The next sub-process is implementation.

The steps in this sub-process:

a) defining efficient benchmarks

b) selecting partners, including investment guidelines and implementation

c) exercising shareholder rights

d) cash management

e) risk management including ESG topics

f) strategic build-up/reduction of portfolios

g) tactical asset allocation (TAA) and disciplined rebalancing

a) Defining efficient benchmarks

A benchmark is defined for each asset class that provides the most efficient representation of the desired risk/return profile from the perspective of the PUBLICA portfolio as a whole.

b) Selecting partners, including investment guidelines and implementation

The requirements for internal and external asset managers are equally stringent. PUBLICA seeks out the most capable partners for each asset class. Where possible, a back-up solution is put in place for each asset class. This redundant approach means that another asset manager can step in promptly if required.

c) Exercising shareholder rights

Voting rights are exercised in the interests of insured members, and dialogues are conducted with the aid of external specialists.

d) Cash management

Liquidity requirements are planned out in advance where possible, using cash management to ensure that all benefits can always be paid, and claims satisfied, when they are due.

e) Risk management including ESG topics

One of the key tasks of risk management is to identify, measure, monitor and steer risks and earnings at the level of overall assets. Risk management ensures that invested assets are managed in accordance with the specifications and that the risk budget is adhered to. Risks within the investment process should be measured as uniformly as possible and assessed consistently. Those risks that are not compensated by a premium are minimised. Unquantifiable risks and their potential impact on the portfolio are identified and assessed annually (ESG risk analysis).

f) Strategic build-up/reduction of the portfolios

Adjustments to comply with new strategic asset allocations are carried out gradually over time, taking account of transaction costs and liquidity levels. PUBLICA Asset Management decides on the speed at which an existing strategic asset allocation is to be adjusted towards a new allocation. The relative performance of the assets of the pension plans is measured against this “pro rata” strategy.

g) Tactical asset allocation (TAA) and disciplined rebalancing

Tactical decisions – i.e. temporary overweights and underweights relative to the “pro rata” strategy – are used to generate added value (higher net return or lower risk) over the medium term. The “pro rata” strategy is rebalanced monthly to ensure that the strategic allocation is implemented in a disciplined manner.

The individual sub-processes within the investment process are monitored regularly by both PUBLICA and external parties. In many cases, a number of external and internal parties are involved in carrying out and monitoring the various steps. Key external parties include the global custodian, which compiles the daily and monthly reporting, the investment controller and the auditors.

Best governance is the cornerstone of PUBLICA’s investment process. It means that advice, decision-making and controlling are consistently separated in order to avoid conflicts of interest. Investment decisions are based on sound data and – where available – well-founded scientific principles, and are transparently documented. The four-eyes principle is implemented efficiently and effectively. Those who manage PUBLICA’s investments must meet stringent professional requirements and demonstrate trustworthiness, integrity and loyalty.