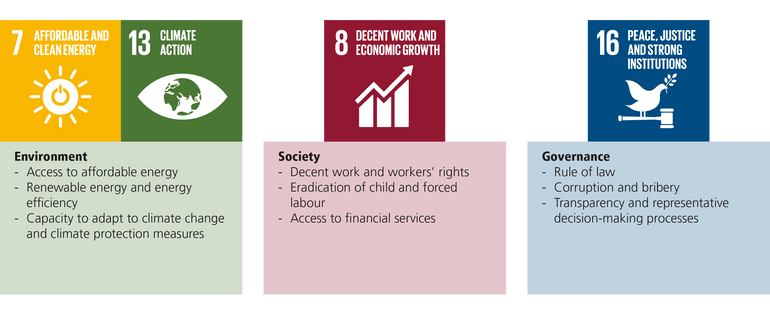

We have received lots of positive feedback on our first report from many readers who appreciate the transparency it creates. We are now publishing our second report on responsible investment. Throughout 2023 our first concern was, as always, the interests of our active members and pension recipients. We expect that, going forward, our customers will want to know more about the environmental, social and business impact of their investments with PUBLICA. This is why we created the Sustainability Asset Management Exchange group within PUBLICA Asset Management last year to embed the topic more deeply. Comprising members drawn from various teams, it dealt in depth with the UN Sustainable Development Goals and their 169 targets. We prioritised four of the UN Goals and, for the first time, measured the contributions made to them by the companies in PUBLICA’s portfolio. The results are presented in our first detailed report starting on page 11.

Biodiversity and climate change are closely linked

In 2023, we began building a knowledge base on biodiversity. This is closely linked to climate change, which exacerbates the loss of biological diversity, in turn further accelerating climate change as carbon sinks (carbon reservoirs) are destroyed and carbon is released into the atmosphere.

PUBLICA’s first step is to address the issue through the existing engagement approach. SVVK-ASIR, of which PUBLICA is a member, has been a supporter of Nature Action 100 since September 2023. This collaborative engagement initiative seeks dialogue with 100 companies in sectors that are heavily dependent on ecosystem services or have a substantial impact on biodiversity loss.

Measuring biodiversity loss is highly complex, locally limited, and multi-dimensional. That makes it more difficult to quantify the financial risks for PUBLICA’s portfolio. Our next step will be to review the available measurement approaches and gain further knowledge as we do so.