It is taking decades for companies to implement the technological changeover from fossil to renewable energy sources, and for governments, companies and households to adapt their behaviour. This is evident from the results of the PACTA Climate Test, which reveals that companies’ five-year plans are on course but are still not sufficient to achieve the Paris climate goals. The PACTA Climate Test is carried out by the Federal Office for the Environment. It evaluates the progress made by the Swiss financial market and individual financial institutions towards achieving net-zero emissions by 2050.

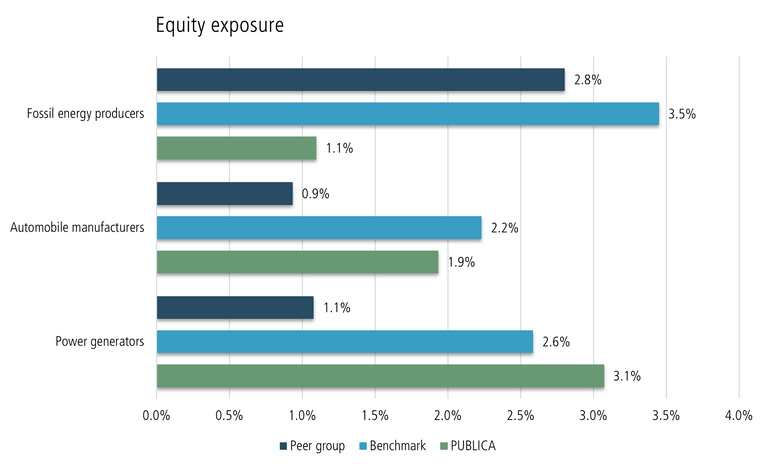

For equities and corporate bonds, PACTA measures the portfolio’s exposure to climate-relevant sectors compared with the market as a whole and the peer group, comprising the 121 participating financial institutions. In equities, PUBLICA’s portfolio is overweighted in power generation compared with the benchmark and peer group, but significantly underweighted in fossil energy producers (oil, gas and coal). Overall, PUBLICA’s portfolio is less exposed to climate-relevant sectors than the benchmark.

Real estate: portfolio’s CO2 emissions down

The Swiss real estate’s Scope 1 CO2 emissions fell, thanks to acquisitions of large new builds with a much better carbon footprint than the rest of the real estate portfolio, and to the replacement of fossil-fuel heating. As a result, real estate is on the targeted reduction path. A similar trend can be observed in the foreign real estate.

Private infrastructure debt classified

We have also successfully classified private infrastructure debt in line with the UN Sustainable Development Goals (SDGs) for the first time. This increases transparency. Working with the external asset managers and our partner Net Purpose, the PUBLICA team has developed a customised questionnaire which allows us to assign the infrastructure investments qualitatively to the relevant UN SDGs.

Gold meets a recognised standard

Finally, a pragmatic approach enabled us to ensure that a large proportion of PUBLICA’s gold holdings meet a recognised standard for combating money laundering and protecting human rights. Nevertheless, investments in precious metals inevitably have an environmental impact. At the same time, they help to diversify the portfolio. This underscores the complexity of investing our members’ pension assets, and the need to take every financial and non-financial aspect into account at all times.